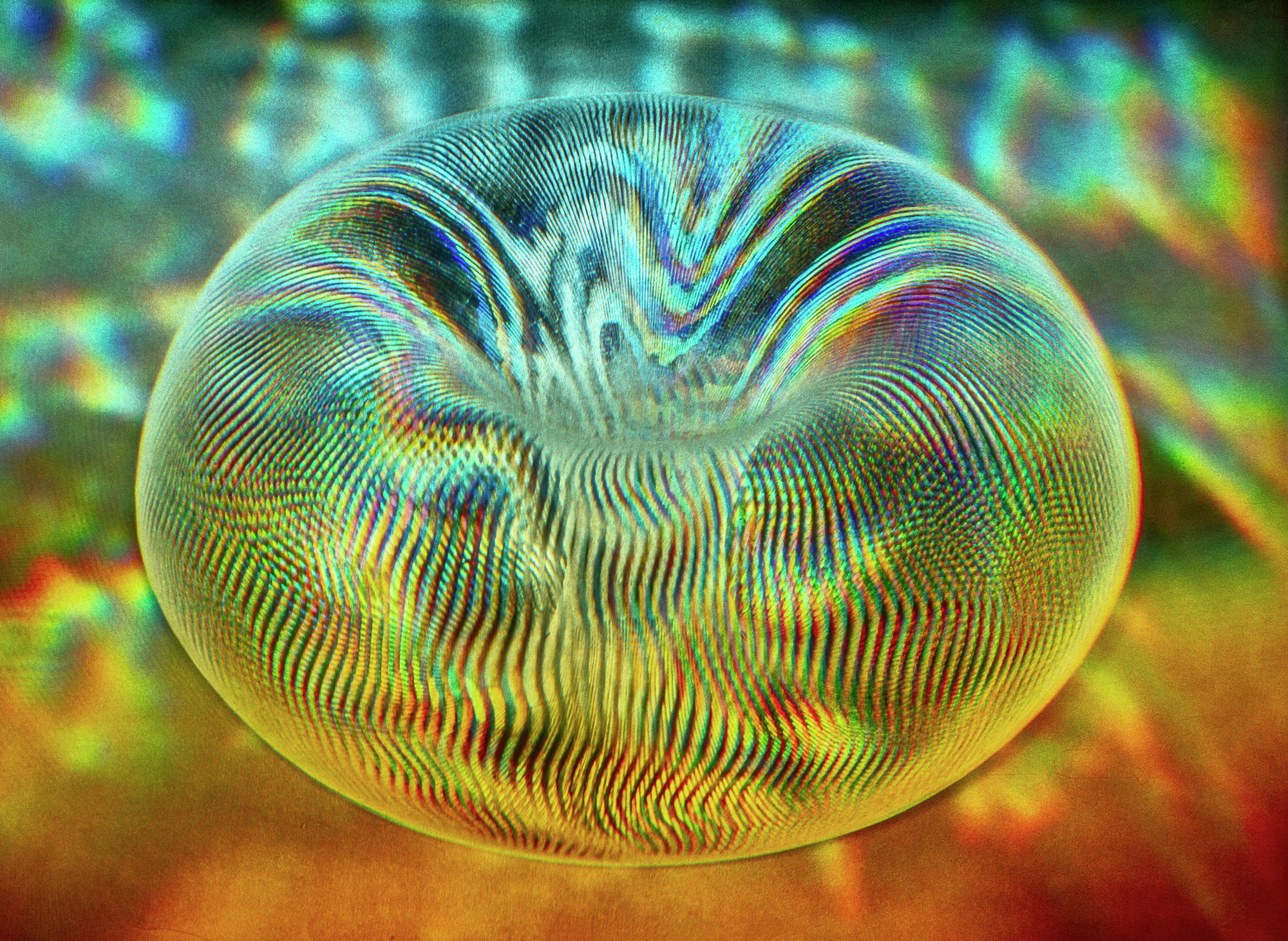

Disney CEO Michael Eisner (left) and former president Michael Ovitz in a brief, happier moment.

IN HOLLYWOOD these days, it’s almost possible to believe Michael Ovitz never happened. Talent agencies are trying to get their clients work, not broker corporate megamergers or prove they’re sharper than Madison Avenue. The Creative Artists Agency, which Ovitz built from zip to an undisputed No. 1 before taking his short-lived stint as president of Walt Disney, is still strong, but no more so than its chief rivals, William Morris and International Creative Management. Most important, nobody believes agents are running the show anymore. “They’re all gone,” one industry leader says of Ovitz and his former partners, Ron Meyer (now president of Universal Studios) and Bill Haber (now an executive at Save the Children). “And to a large degree, it’s business as usual.”

And yet evidence of Ovitz’s handiwork is everywhere. Sony and Matsushita, the Japanese electronics giants he helped persuade to go into show business, are billions of dollars poorer for the experience. Disney is still feeling the afterburn from his 14 months as president and the $114 million package (at the current stock price) it gave him to go away. And Hollywood shows no signs of recovering from its Ovitzian obsession with image, which has seemingly become more important than the actual production of entertainment. Little wonder the top parlor game in town is plumbing the psychic hole left by his sudden diminution.

Friends say Ovitz realized only gradually just how damaging the Disney fiasco would be; his initial reaction was simply relief at being cut loose. Aside from a $25 million pledge to the UCLA Medical Center last February and an evening in April chairing a Manhattan writers benefit that veered unexpectedly into a roast, he’s kept a low profile. “I don’t have much to say to anybody about anything,” he said, declining to be interviewed for this article.

Friends say Ovitz realized only gradually just how damaging the Disney fiasco would be; his initial reaction was simply relief at being cut loose. Aside from a $25 million pledge to the UCLA Medical Center last February and an evening in April chairing a Manhattan writers benefit that veered unexpectedly into a roast, he’s kept a low profile. “I don’t have much to say to anybody about anything,” he said, declining to be interviewed for this article.

“Everyone has an opinion about my life, and I don’t really have one at this point. Twenty-five years of building CAA—it’s as if I was never there. One year at Disney, and the rest of it, I guess, was an accident.”

Hardly an accident, but not what it had been made out to be either. Was Ovitz invented by the press, or did he invent himself for the press? Either way, the myth that grew up around him was a conspiracy of spin that Hollywood’s rank and file bought into. Long hyped as the most powerful figure in Hollywood, he has inadvertently demonstrated where the real power lies—with people like his former boss, Disney Chairman Michael Eisner, who run the global entertainment conglomerates that talent agents merely help fuel. Ovitz’s fall has led to a wrenching realignment of perception and reality in a town where the two are often thought to be identical—though the studio chiefs who say yes or no to those $100 million projects knew the score all along.

Now, at 50, Ovitz finds himself just another mogul without portfolio, in the company of former HBO chief Michael Fuchs and former Sony Corp. of America chief Mickey Schulhof. “I think it’s impossible to judge whether Michael would have been an effective executive,” says Herbert Allen, the New York investment banker, citing the resistance Ovitz encountered from other Disney execs. “But my guess is, it’s not his strength. He’s visionary, entrepreneurial, charismatic—but it has to be his show, and I think it should be a smaller show.”

Ovitz may be thinking smaller, but apparently not too small. He’s hired David Maisel, a gung-ho young consultant who followed him from CAA to Disney, to help with his new business venture—said to be a multimedia startup, or perhaps a filmmakers’ company modeled on the original United Artists. One investment banker who saw a preliminary business plan says it called for capital of $1 billion to $2 billion, which he told Ovitz was more than he could raise.

Hollywood comebacks are hardly unheard-of—Ronald Reagan comes to mind—and even today Ovitz remains such “an icon of fear,” as one entertainment executive puts it, that almost no one, friend or foe, will talk about him on the record. But most seem less fearful of retribution than of having the notoriously thin-skinned Ovitz chew their ears off. “It’s not that I’m afraid of him,” pleads a friend, “it’s that my life is too short.”

“Everyone has an opinion about my life, and I don’t really have one,” says Ovitz. “One year at Disney and the rest, I guess, was an accident.”

Image-obsessed for years, Ovitz has succeeded in being viewed merely as someone obsessed with his image. “He was always old,” says a former studio executive—earnest, focused, calculating. Except on Saturday mornings, when he and Eisner used to go to kids’ premieres in sweatshirts and baseball caps, Ovitz was rarely seen in public without a suit. But that aberrant maturity was what enabled him to build CAA—which he and four other young William Morris television agents launched in 1975—into a firm that not only had a lock on most of Hollywood’s top actors, writers, and directors but also served as a go-between for show business and corporate America.

Ovitz’s first big customer was another newcomer from television, Columbia Pictures Chairman Frank Price. Later, Columbia producer Ray Stark arranged for Ovitz to meet Herbert Allen, who controlled the studio. Through Allen, with whom he spoke daily for years, Ovitz learned something about investment banking and developed relationships with companies like Coca-Cola. Then, in 1989, Allen and Coca-Cola sold Columbia to Sony—a deal that established Ovitz as a corporate marriage broker, even though others involved claim he had almost nothing to do with it.

By this time, CAA dominated show business as no agency had since the 1950s, when Lew Wasserman took MCA, then the leading talent agency, into television production. Just as Wasserman led Hollywood through the breakup of the studio system to a place where movies and TV could profitably coexist, Ovitz anticipated the convergence of entertainment, communications, and technology into a single business operating on a global scale. He was also a born salesman—”someone who oozed confidence, coolness, and massive competence,” in the words of Sony Corp. of America President Howard Stringer.

A Decade of Reporting on the Global Media Conglomerates |

In the 1990s and into the 2000s, a series of ego-fueled mega-mergers led to the creation of six global media conglomerates: News Corp., Sony, AOL Time Warner, Vivendi Universal, Viacom and Walt Disney. For most, it would not end well. |

Can the PS3 Save Sony?The company that created the transistor radio and the Walkman is at the precipice.

|

Barry Diller Has No Vision for the Future of the InternetThat’s why the no-nonsense honcho of Home Shopping Network and Universal is poised to rule the interactive world.

|

The Civil War Inside SonySony Music wants to entertain you. Sony Electronics wants to equip you. Too bad their interests are diametrically opposed.

|

Big Media or BustAs consolidation sweeps the content and telecom industries, FCC Chairman Michael Powell has a plan: Let’s roll.

|

Vivendi’s High Wireless ActWill a global media company with continent-wide mobile distribution prove unbeatable?

|

Reminder to Steve Case: Confiscate the Long KnivesTime Warner brings fat pipe and petabytes of content to AOL—plus a long history of infighting and backstabbing.

|

Think Globally, Script LocallyAmerican pop culture was going to conquer the world — but now local content is becoming king.

|

Edgar Bronfman Actually Has a Strategy—with a TwistThe Seagram heir is challenging Disney in theme parks and spending billions to be No. 1 in music. Can this work?

|

There’s No Business Like Show BusinessA handful of powerful CEOs are battling for the hearts, minds, and eyeballs of the world’s six billion people.

|

What Ever Happened to Michael Ovitz?Striving to make his comeback, CAA’s superagent is now an unemployment statistic. Seven lessons to be learned from the fall of the image king.

|

Can Disney Tame 42nd Street?Disney is pouring millions into one of Manhattan’s most crime-ridden blocks. What does Michael Eisner know that you don’t?

|

Twilight of the Last MogulLew Wasserman has been shaking Hollywood since the ’30s. When Seagram bought MCA, was he really out of the loop, or was he king of the dealmakers to the last?Los Angeles Times Magazine | May 21, 1995 |

He didn’t do it alone, of course. He had dozens of handpicked agents behind him, plus his partners and some key executives to keep things running. He relied on Meyer to babysit the talent; on Haber to run the immensely profitable television operation; on Sanford Climan to negotiate deals and do the economic modeling that enabled CAA to tell studio chiefs exactly what such-and-such a star was worth at the domestic box office, at the foreign box office, in the videocassette market, in network and syndication and cable sales. “Mike is like a great racehorse,” says a former associate. “He needs to be saddled properly and he needs the right track conditions and the right rider and the right trainer and he can run a great race. Without those, he’s capable of running up into the stands.” As he did at Disney? “I wasn’t surprised,” says the associate. “I know what Mike can’t do. But Mike doesn’t know what he can’t do.”

In talking with this person and dozens of others who know Ovitz well, the picture emerges of a man who repeatedly overreached, who alienated people needlessly over issues of money and trust, who could take the measure of everyone except himself, who exuded control yet was strangely out of control. Take the incident earlier this year, in which Meyer told him over a rapprochement breakfast about an estate he wanted to buy in Malibu, only to learn later that Ovitz was trying to buy it out from under him. “That’s typical Michael,” says another ex-associate. “I think there’s a good person there, but a very conflicted person. A person who knows the right thing to do but who is also oblivious. I don’t know what happened. I don’t!”

Probably, no one does. But while there are no simple explanations for such behavior, there are some lessons to be learned from Ovitz’s experience:

1. Something’s wrong when the middleman seems more important than the people he’s bringing together.

Until a few years ago, talent agents were nonentities to anyone who didn’t read Variety. But when The New York Times Magazine put Ovitz on its cover in 1989 and Premiere then put him atop its list of Hollywood’s most powerful people, a star was born. “I always thought it was a funny thing to anoint the middleman as king,” grouses one of the town’s leading citizens, but no matter: The press needed someone to symbolize the forces reshaping the entertainment industry, and Ovitz, with his Zen aura and his ominous mien, was a more obvious choice than any of the studio heads, none of whom towered over their competitors the way he did. Power in show business is diffuse, but it’s still held, bottom line, by the handful of people who write those big checks. And while the balance of power has been shifting for decades to the talent and the agents who handle them, agents are still no bigger than the perceived drawing power of the stars they represent. In a business of illusion, nothing is more illusory than an agent’s power.

2. Fear only takes you so far.

“It wasn’t power Mike had,” says a former associate, “it was influence.” The difference, of course, is between command and persuasion. Ovitz seemed to be in command because the top money earners he represented (Tom Cruise, Tom Hanks, Kevin Costner, Sean Connery, Sylvester Stallone) enabled him to leverage his persuasiveness with threats. He dangled the carrot and wielded the stick, suggesting to executives and producers—who invariably wanted not one client but several, for projects now and in the future—that either good or harm could come from their dealings with him. Along the way he became so identified with the package deal—rolling lesser clients onto a single bill with big stars, a practice that actually dates to vaudeville—that people came to believe he’d invented it.

Ovitz’s negotiating technique, people who know him well maintain, was less a tactic than a character flaw: He was feared because he was a bully. “I think it’s just part of his genetic coding,” says one Hollywood power. “He tends to run over people. He created a lot of enemies over time.” By the late 1980s, some studio executives were feeling abused by Ovitz and hoping he would fall. “People took it until they didn’t have to,” says a well-placed observer, “and then they gave it back.”

3. If you can’t remember the little people who helped you reach the top, at least remember the big people.

Not everyone who dealt with Ovitz at CAA felt abused—Price, the former Columbia chief, calls him “a very good friend, somebody you can talk to”—but enough did to make it a pattern. And it wasn’t just his willingness to intimidate; it was the way he forgot about payback. “Mike doesn’t ever return favors,” says a veteran studio executive, echoing a common refrain. “He used to call me every day and tell me how great I was at my job, but at the end of the day he didn’t do me one favor, even when I needed it.”

Ovitz was a man who repeatedly overreached, who alienated people needlessly, who exuded control yet was strangely out of control.

Ovitz’s failure to play quid pro quo made him enemies, some of them powerful enough not to care what they said about him. One of the first was Stark, who complained that Ovitz dropped him after he’d made that crucial introductory phone call to Allen. “Ray is a give-and-take fellow, but he’s more inclined to give,” says Allen, “and I think he felt Ovitz was inclined to take.” Then there was Bernie Brillstein, the manager-producer who gave Ovitz such clients as Dan Aykroyd, John Belushi, and Gilda Radner—until Brillstein sold his production company and Ovitz, Brillstein says, demanded a commission. And David Geffen, who had several run-ins with Ovitz during the troubled production of Personal Best, the 1982 debut of Geffen Films. “David felt he was helping Mike with a lot of things,” says an executive who’s dealt extensively with both. “He felt Mike was double-crossing him.”

But Ovitz, who declined repeated requests to comment for this article, may have made his biggest mistake in not taking care of his closest partner, CAA President Meyer. Meyer was the smooth talker who kept the talent happy while Ovitz played corporate kingpin, the cleanup man who tried to make good on whatever Ovitz didn’t deliver. They spoke constantly, finished each other’s sentences, vacationed together with their families in the Mediterranean. “Insiders knew Ron was every bit as juicy as Mike,” says a former CAA colleague; but outsiders heard only about Ovitz. “Mike desperately needed Ron,” says another ex-colleague, “but it was always looked at like Batman and Robin. Ron resented that.”

4. Don’t buy your own myth.

At first, CAA insiders insist, Ovitz fought the media attention and tried to quash it. When that didn’t work, he embraced it, telling himself the image of omnipotence would make his job easier. Before long, he was trying to control it. Along the way he came to believe it.

People who know Ovitz say the media myth filled a need—the same need filled by the overweening drive to succeed that led to the myth in the first place. “He was probably the most insecure person I ever met,” says Brillstein. “That’s why he was so driven.” Ovitz’s insecurities can only have been fed by the nature of agenting. No. 1 or not, he was still in the personal-service business, a sort of glorified valet liable to be pulled out of any meeting the moment Barbra Streisand began to worry whether she should have a face-lift. “Being a superagent is wearing,” says Allen. “He was the best ever, but I think he got burned out by it.” And while Ovitz made a good living at CAA, he was hardly in the same league as Geffen or some of Allen’s pals, like Warren Buffett or Bill Gates.

Ovitz talked to Price about quitting as long ago as 1985. His model was Wasserman, the man who took MCA from talent agency to entertainment colossus. But to do that, you had to take over a corporation, and after Wasserman, antitrust rules kept talent agencies out of the rest of the business. With his wealth tied up in CAA, Ovitz could only make the jump to bona fide media mogul by finding someone to buy him out and give him a job. It almost worked with Sony in 1989, but Ovitz wanted so much that Sony opted for cheaper talent: Peter Guber and Jon Peters. Ovitz then insisted he’d never wanted the Sony job anyway.

5. Know what you want.

Nonetheless, he was eager for a bigger stage. “He’d spent years critiquing the way these entertainment companies were run,” says Gordon Crawford of Capital Research in Los Angeles, which has major holdings in Disney and its competitors. “I think he wanted to roll up his sleeves and try to run one.” In 1995, when Seagram bought 80% of MCA from Matsushita, Ovitz had another chance. He had played a pivotal role in bringing Matsushita and MCA together five years earlier, and he’d gotten so close to Seagram President Edgar Bronfman Jr. that Bronfman assumed Ovitz would run any entertainment company Seagram bought. Ovitz’s failure to close this deal for himself proved to be his undoing.

Part of the problem was Wasserman and his wife, Edie. A fearsome woman who’d zealously nurtured her husband’s reputation during their half-century in Hollywood, Edie disdained Ovitz for daring to style himself the new Lew. Wasserman was already distrustful because Ovitz had floated a wildly unrealistic price—around $80 a share—to get him to start bargaining with Matsushita (which eventually bought MCA for $66 a share). Now he was furious Ovitz hadn’t told him Matsushita was selling MCA to Seagram. Secrecy was Seagram’s condition for the deal, but Wasserman felt Ovitz should have found some way to let him know.

Over dinner at his Manhattan townhouse, Bronfman said he didn’t realize Meyer and Ovitz were separable. “We are now,” Meyer replied.

Press reports had Ovitz in the thick of negotiations, but other participants say he was out of the loop, his role largely ceremonial. He could hardly admit that, however. “He was in a terrible conundrum,” says someone close to the deal. “Here was a guy who got so much currency by pretending to know everything that he lost a friend.” Maybe more than a friend: Wasserman let it be known he’d walk if Ovitz came in.

But Ovitz didn’t need Wasserman to blow the deal; he was quite capable of doing it himself. He began by asking for an outrageous sum—upwards of $250 million. Bronfman wasn’t thrilled, but he was willing to defer the issue while they explored other questions. How much authority would Ovitz have? Would he report to Bronfman or directly to Seagram’s board? With each new demand, Bronfman grew increasingly dismayed: Weren’t they supposed to be a team? In the end, the money was almost irrelevant. “You start to learn a lot about each other,” says a former colleague, “and I think Mike showed parts of himself that Edgar found unattractive.”

Why did Ovitz, the master negotiator, flub his own biggest deal? Supporters maintain he was genuinely ambivalent. At CAA he was boss; here he’d have to answer to Bronfman or else to his father and uncle, who control the board. Less charitable associates say he didn’t know himself well enough to know what he wanted. Instead, his agent instincts took over: Having asked for the moon and apparently gotten it without a fuss, he had to ask for more.

The talks ended at 2 a.m. on a Monday in June 1995. At CAA’s I.M. Pei headquarters in Beverly Hills, the day began with a meeting at which Ovitz announced he’d be staying after all. Applause broke out, but it was loudest at the back, where the junior agents stood. Ron Meyer had been telling Ovitz they were in the 20th year of a 12-year plan, and many top agents felt the same way. But no one was more upset than Meyer himself, who’d been planning to follow Ovitz to MCA and who now saw his chance to cash out vanish.

Bronfman and Meyer had never met, but they had mutual friends—Geffen among them—who urged Bronfman to hire Meyer alone. When Bronfman invited Meyer to dinner at his New York City townhouse, Meyer expressed an interest in helping him run MCA. Bronfman said he didn’t realize Meyer and Ovitz were separable. “We are now,” Meyer replied.

With Meyer out the door and everyone aware that Ovitz had been angling for a job, Ovitz’s days as a superagent were over. “It’s almost like putting a company in play,” says Crawford. “It’s hard to put the genie back in the bottle.” But then, in the best theatrical tradition, a deus ex machina appeared in Eisner. The Disney chief had tried to hire Ovitz before, once going so far as to spend an afternoon persuading Meyer to get Ovitz to take the leap. Never mind that the deal Disney offered now wasn’t nearly as lucrative as Seagram’s, or that it was far more tied to stock performance, or that instead of CEO, Ovitz would be made president without even the rank of COO. Disney offered a bigger stage, and Ovitz needed one badly. He could console himself with the thought that unlike the Bronfmans, Eisner wasn’t necessarily going to be around forever.

6. If people are dancing on your grave, chances are you dug it yourself.

Before Ovitz started at Disney, several people—former Coca-Cola President Don Keough, former Cap Cities/ABC Chairman Tom Murphy—cautioned him to keep his mouth shut for a year, to go around the company learning the business and asking how he could help. It was good advice: He was moving from a Beverly Hills service outfit with at most $200 million in annual revenues to a global enterprise that, when its just-announced merger with ABC went through, would be pulling in $19 billion a year from movies, TV, theme parks, sports teams, and publishing. But Ovitz approached his new job as if he were still what he’d never been: the most powerful man in Hollywood.

“I’m not surprised Ron was more adaptable,” says an ex-associate. “He knew he was in heaven at CAA, but he also knew he wasn’t God.”

July 7, 1997

July 7, 1997