In 1995, Seagram CEO Edgar Bronfman, Jr. shocked the business world by buying MCA Universal, an early but increasingly sclerotic entertainment conglomerate, from Matsushita Electric Industrial Co. of Japan. Business pundits were not amused, Hollywood even less so. The idea that he might in fact have a viable plan was considered a joke. But why not hear him out?

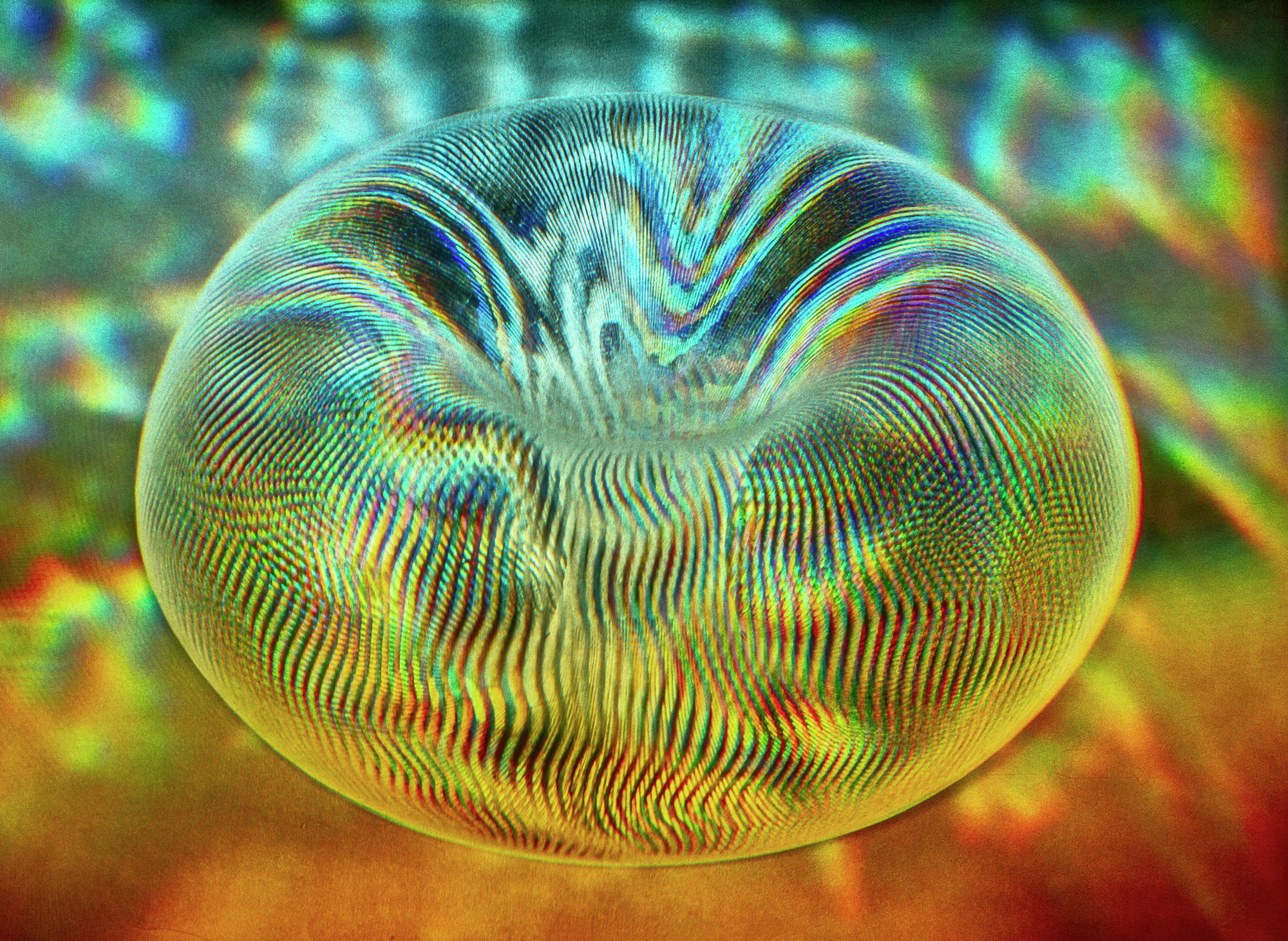

Coming soon in Orlando: Islands of Adventure is a $2.1 billion bet that vacationers want something edgier than Disney. Photographs by David Strick

ONE THING ABOUT EDGAR BRONFMAN JR.: He’s used to the bird’s-eye view. Soaring over the Eastern Seaboard in a Gulfstream V at 46,000 feet, you get the big picture—so I guess we shouldn’t be surprised that a guy who grew up flying with his dad on the corporate jet would orchestrate a sequence of deals that’s transformed not just Seagram Co., his $14-billion-a-year patrimony, but entire industries. Thanks to buttons the 43-year-old Bronfman has pushed in the past year alone, PepsiCo has acquired Tropicana in a high-stakes bid to open a second front in its never-ending war with Coke; Barry Diller has been given a top-rated cable network but denied the chance to acquire CBS or NBC; the Japanese city of Osaka has begun a $1.4 billion effort to transform its derelict waterfront into a Hollywood theme park; PolyGram’s attempt to establish a European beachhead in Hollywood has been aborted; a company once derided as the Music Cemetery of America has become the dominant force in the global music industry; and 3,000 music-business employees around the world are looking for work, even as 6,000 Floridians line up to staff a new theme park in Orlando.

Coming soon in Orlando: Islands of Adventure is a $2.1 billion bet that vacationers want something edgier than Disney. Photographs by David Strick

As with most actions that come from on high, however, the pattern behind these moves has not always been easy to divine. Four years ago, when Bronfman sold most of his company’s 24.5% stake in Du Pont in favor of the entertainment conglomerate then known as MCA, he was dismissed as a starstruck dilettante bent on buying his way into Hollywood. By doing nothing, conventional wisdom tells us, he could have avoided reams of scathing publicity while watching his Du Pont holdings nearly double. Instead, he sold Du Pont for $8.8 billion, leaving more than $7 billion on the table at current prices. Similarly, he bought 15% of Time Warner and sold it just as it began its recent climb. And in buying MCA, he laid out $5.7 billion for 80% of a company that was last, or close to last, in all its businesses—television, publishing, music, theme parks—except movies. In movies it had Steven Spielberg, who was leaving for DreamWorks SKG.

“To me, it was step one,” says Bronfman. “It was a second-tier entertainment company. It had to become a first-tier entertainment company.” And so, with the $10.4 billion acquisition of PolyGram, he’s essentially doubled his bet, loading up on music as well as theme parks while spinning television off to Diller—a move Hollywood regards as unfathomable—and letting the film studio flounder. Does he have a plan?

A Decade of Reporting on the Global Media Conglomerates |

In the 1990s and into the 2000s, a series of ego-fueled mega-mergers led to the creation of six global media conglomerates: News Corp., Sony, AOL Time Warner, Vivendi Universal, Viacom and Walt Disney. For most, it would not end well. |

Can the PS3 Save Sony?The company that created the transistor radio and the Walkman is at the precipice.

|

Barry Diller Has No Vision for the Future of the InternetThat’s why the no-nonsense honcho of Home Shopping Network and Universal is poised to rule the interactive world.

|

The Civil War Inside SonySony Music wants to entertain you. Sony Electronics wants to equip you. Too bad their interests are diametrically opposed.

|

Big Media or BustAs consolidation sweeps the content and telecom industries, FCC Chairman Michael Powell has a plan: Let’s roll.

|

Vivendi’s High Wireless ActWill a global media company with continent-wide mobile distribution prove unbeatable?

|

Reminder to Steve Case: Confiscate the Long KnivesTime Warner brings fat pipe and petabytes of content to AOL—plus a long history of infighting and backstabbing.

|

TV or Not TVRupert Murdoch aims to capture Europe’s interactive TV market with a Sun set-top strategy. But a growing Microsoft alliance has different plans.

|

Think Globally, Script LocallyAmerican pop culture was going to conquer the world — but now local content is becoming king.

|

Edgar Bronfman Actually Has a Strategy—with a TwistThe Seagram heir is challenging Disney in theme parks and spending billions to be No. 1 in music. Can this work?

|

There’s No Business Like Show BusinessA handful of powerful CEOs are battling for the hearts, minds, and eyeballs of the world’s six billion people.

|

What Ever Happened to Michael Ovitz?Striving to make his comeback, CAA’s superagent is now an unemployment statistic. Seven lessons to be learned from the fall of the image king.

|

Can Disney Tame 42nd Street?Disney is pouring millions into one of Manhattan’s most crime-ridden blocks. What does Michael Eisner know that you don’t?

|

Twilight of the Last MogulWith a mixture of charm, intelligence and ruthlessness, Lew Wasserman has been shaking Hollywood since the ’30s. Was he really out of the loop when Seagram bought MCA, or was he king of the deal-makers to the last?

|

Well, actually, yes. It’s as bold and potentially as big as Rupert Murdoch’s scheme to put the entire globe under his satellite footprint, or Gerald Levin’s stubborn insistence on staking the future of Time Warner (parent of Fortune‘s publisher) on cable. Could Bronfman turn out to be the next Murdoch or Levin? Some on Wall Street are finally giving him the benefit of the doubt. Seagram shares, which hit a low of $26 last fall, are now around $46, and Merrill Lynch analyst Jessica Reif Cohen has set a target price of $60 within 12 months. But in Hollywood, where the buzz on Bronfman is positively scathing, he looks more like infotainment’s answer to “Wrong Way” Corrigan, the 1930s flying ace who left New York for California but landed in Ireland instead.

Today we’re flying to Orlando, home to the first leg of Bronfman’s controversial biped entertainment strategy. The basic premise is this: The information economy will leave people across the planet with ever more time on their hands. Nobody expects them to fill it by consuming more booze, but they’ll have to do something for fun. By buying MCA/Universal, the only entertainment conglomerate with a Hollywood-themed park, and merging it with PolyGram, the world’s leading record company, Seagram can be No. 1 in music and No. 2 in recreation—albeit a distant No. 2 to Disney. The Diller deal is designed to allow Seagram to recapture its television properties when Diller makes his exit; movies, a wild-card business that’s not for the faint of heart, will exist largely to lend legitimacy to the theme parks. Let’s be clear: This is not the 250-year plan Matsushita’s founder announced in 1932, some six decades before his successors bought MCA and then dumped it on Bronfman. But it’s long term, it’s radical, and it totally defies conventional wisdom.

In the new Seagram, spirits and wine, the business Bronfman’s grandfather started in 1916, will account for only about a quarter of the company. Universal Studios, the film and theme-park division, will make up another quarter, while Universal Music will amount to nearly half. But does it make sense to place such a huge bet on music, when the Internet is about to turn the business on its head? To be on the sidelines in television, when cable channels like USA are where the sizzle is in entertainment? To challenge Disney in theme parks, when Asia is on its knees and people are beginning to wonder if the whole theme thing has peaked?

We’ve landed in Orlando now, and the highway sign coming up says UNIVERSAL STUDIOS NEXT RIGHT. “I like to see signs like that,” says Bronfman. I’m feeling pretty relieved myself: Hey, at least we’re not in Ireland.

ISLANDS OF ADVENTURE, Universal’s soon-to-open addition to the mix, is one cool park. The existing park—Universal Studios Florida, with its “Ride the Movies” theme—is an invitation to step inside the big screen: E.T. Adventure, Back to the Future…the Ride. The new one uses the movies as an elaborate excuse to shoot you through the air, dump you into the water, toss you upside down, and otherwise subject you to the rigors of extreme fun. The best part isn’t even taking the rides yourself; it’s watching people’s faces as they whiz past. Or so I conclude from the construction crew’s snickers as I extricate myself from one of the Dueling Dragons—twin roller coasters that come within inches of each other at 60 mph. Forget Cape Canaveral; if John Glenn really wanted to prove something, he’d try this.

“We’re a little edgier,” Bronfman had told me earlier in his Park Avenue office, in the Mies Van Der Rohe temple to modernism that is the Seagram Building. “What is Disney? Disney is family, it’s fun, it’s warm, it’s safe. We’re not. And that means we’re going to skew to a slightly older audience. North of 8, north of 9—that’s who we’re going after, plus parents.

“Our brand of entertainment—and I think we can brand it—is based on Hollywood, based on energy, exhilaration, excitement. When we bought Universal Studios and I started saying ‘brand,’ people laughed at me—‘This kid does not know what he’s talking about. Nobody goes to a movie because it’s a Universal movie.’” He shot me an exasperated look. “I know that. But Universal, or Warner Bros. or Paramount, can be leveraged into a brand if you can identify what it means and then take that meaning and generate revenue across new businesses.”

A short walk from Islands of Adventure, at the entrance to the studio theme park, streams of tourists are posing for snapshots in front of a globe bearing the Universal logo. At 24 feet, the globe could have been a lot bigger—but then you wouldn’t get the logo in your photos. Bronfman all but chokes up when he sees it. “It’s the symbol of our rebirth,” he says. “It’s here.”

Bronfman put his money on recreation, but parks take time to build. “People say there’s no direction,” he says. “Now they can connect the dots.”

Between the two park entrances, crews hammer away at CityWalk, a nighttime fun zone modeled after the one at the original Universal Studios in North Hollywood. With a 20-screen multiplex, a Hard Rock Café and concert hall (Hard Rock is owned by the Rank Organization, a fifty-fifty partner in the Florida parks), and theme restaurants ranging from Bob Marley to Nascar, CityWalk is meant to encourage folks to stay into the evening. Nearby, bulldozers are clawing out a harbor for the Portofino Hotel, a 750-room Loews resort that’s supposed to look like the picturesque Italian fishing village—and kind of does, if you stand where the Mediterranean should be. “It’s almost nicer than the original Portofino,” observes Jon Tisch, CEO of Loews Hotels.

All this—the new park, the restaurants, the Portofino, future hotels still on the drawing boards—is intended to turn Universal into a destination, instead of a place to go after you’ve done everything at Disney World. Seagram even hopes to make a virtue of its small scale: With 840 acres to Disney’s 28,000, the place is manageable enough to let you send the kids to Dr. Doom’s Fearfall (don’t ask) while you stay behind to catch the Lucy tribute. Will people come? Enough of them, no doubt, to make Universal a lot more competitive with Disney World, which last year drew 4 ½ times as many visitors. But tourism in central Florida is flat; admissions at Disney’s new Animal Kingdom have come largely at the expense of its other Florida parks (though not of Universal’s). Meanwhile, the theme-restaurant business has cratered as a result of lousy food and ill-considered expansion schemes. A prime victim: the Rank Organization, whose CEO resigned in October amid declining results—but not before Rank told analysts it was looking for a way out of its partnership with Universal.

Park President Tom Williams, who saw Orlando tourism take a dip in the early ’90s only to hit new records, dismisses fears that the town is overbuilt: “I think it’s going to continue to grow forever,” he says. As for Rank, which puts up half the money but gets none of the management fees, Bronfman says there are plenty of investors who might like to buy its stake—including, potentially, the public. Meanwhile, Universal is moving full tilt: In the past eight months it has acquired Wet ’n’ Wild, a water-park operator whose Orlando flagship is just across the freeway; bought 2,000 acres beside the Orlando Convention Center; bought 37% of Port Aventura, an Anheuser-Busch park outside Barcelona; opened a “Hollywood Adventure” in downtown Beijing; and flown Arnold Schwarzenegger to the ground-breaking in Osaka, a drab commercial city of 10.7 million souls where, as Universal executives like to point out, there is absolutely nothing to do.

“PEOPLE SAY THERE’S NO DIRECTION TO THE COMPANY,” Bronfman says as we jet out of Orlando. “Now they can start to connect the dots.” But a big reason people say there’s no direction is that Bronfman has had so much trouble finding good people to run the place for him. Entertainment companies often are judged by the quality of their studio management, and in Universal’s case this has been nothing short of disastrous. When his first choice to head Universal, Creative Artists Agency Chairman Michael Ovitz, asked for the moon, Bronfman hired Ovitz’s deputy, Ron Meyer, to be COO—in effect, No. 2 to a vacuum. Meyer, who had no executive experience outside Creative Artists, brought in two trusted friends—his attorney, Howard Weitzman, and the agency’s corporate strategist, Sandy Climan. Not until a year after he bought MCA was Bronfman able to bring in Frank Biondi, who’d just been fired as president of Viacom. Of the four who were hired, only Meyer remains today.

At the time, Bronfman said he didn’t want to run Universal himself because he wanted someone with more experience in show business. A bigger consideration, he says now, was the deals he had yet to do. “I couldn’t operate the businesses myself and do all the transformational work that was required to get us where we are today,” he says. “And I didn’t know whether that was going to happen in a year or five years. I just knew I couldn’t do both.”

But while Bronfman was pursuing his transformational work, strange things were happening at Universal City, the onetime chicken ranch that’s been Universal’s home since Carl Laemmle set up his cameras there in 1915. Meyer, whose major job qualification was his relationships with talent, tried to plug the hole left by Spielberg with an avalanche of deals (Demi Moore, Tom Hanks, Danny De Vito, Mike Nichols, Will Smith, the Zucker brothers . . . ) that have yet to pay off. Weitzman, who seized control of the recreation group, started to reposition the theme parks away from the studio—even though the studio was their reason for being. Casey Silver, the studio chief, saw production and marketing heads come and go until he was shown the door himself. Meanwhile, Seagram accountants from New York tried to grope their way to a film strategy with their calculators. Observing that big-budget pictures on average produce the highest returns, and somehow failing to note that they also carry the greatest risk, the number crunchers asked questions like, Why don’t you just make six giant pictures a year? “Literally,” says one insider, “that was a conversation.”

Then there was reengineering—the transformational work Bronfman wanted to do on MCA. In 1962, when MCA—then a tough, fearsome talent agency/television producer that had dominated Hollywood since the twilight of the studio era—bought Universal, it created the prototype of the modern entertainment conglomerate. But the place slowly ossified as its long-time chairman, Lew Wasserman, clung to rigid notions about the business. To crack open the bureaucratic maze he’d acquired, Bronfman pulled people from their jobs and teamed them with consultants for two years of meetings, which spawned novelties ranging from companywide shipping discounts to software that can tell you when cable rights to Animal House will be available in Poland. Cost savings were achieved, but at an enormous expenditure of institutional credibility: The tales that ricocheted through Hollywood confirmed the town’s worst fears about outsiders buying into the film business.

Trouble in Hollywood: Can Ron Meyer (shown on the set of Kevin Costner’s latest) lead Universal Pictures out of the cellar?

Strangest of all was the Diller deal. Having endured the humiliation of taking Viacom to court over USA Networks—a highly restrictive fifty-fifty cable partnership Seagram and Viacom had inherited and couldn’t get out of—Bronfman won complete ownership in October 1997. But once he had USA, what was he going to do with it? For that matter, what was he going to do with Universal’s TV-production business, which was stagnating when Seagram bought it and could soon turn into a money pit, thanks to the shifting economics of broadcast television?

USA, a dull but established cable network serving 97% of American cable households, would seem to be a good fit with Universal’s production facilities and its library, which contains hit shows ranging from Law & Order to Alfred Hitchcock Presents. But to compete with the likes of Time Warner and Viacom, Seagram would need to spend billions buying additional properties—CBS, for example, or Turner Broadcasting. Instead, Bronfman opted to partner with his friend Diller.

Diller got USA plus Universal’s domestic TV-production-and-distribution operations in exchange for $1.3 billion in cash and 46% of his new company, which he promptly named USA Networks. Bronfman got the right to buy the rest of the company when Diller exits the scene. He sees the deal as “a great opportunity—I can rent Barry Diller, I can own the company over the long term, I can ride the upside in the meantime, and between his assets and our assets we can create a television company that’s far more compelling than what I can do inside Universal.” Hollywood viewed it as an amputation.

Then, over the summer, Diller started talking with CBS and General Electric (NBC’s corporate parent) about buying his way into the big leagues—only to have Bronfman nix the deal. Bronfman has top-up rights—a guarantee he’ll always be able to buy enough stock to maintain his 46% stake should Diller make an acquisition that would dilute it. But that would mean shelling out cash at a time when the PolyGram acquisition was already leaving Seagram with more than $9 billion in debt. How did Diller—who was thwarted once before in an attempt to buy CBS—feel about having Bronfman tell him no? “I think each of us goes away from it feeling no harm, no foul,” Diller maintains. Others view it differently. “In the short term, he made a good deal,” a leading television agent says of Bronfman. “In the long term, he probably prevented himself from taking Seagram into the 21st century as a vertically integrated studio/network/theme park à la Disney.”

Bronfman, however, had another consideration. “The part I couldn’t say was that I needed the money back to get something else,” he says now. “But that was very much our plan.” The deal closed a year ago, on Feb. 12. Six days later, Bronfman met with Cor Boonstra, CEO of Philips—the Dutch electronics company that held 75% of PolyGram.

ALMOST FROM THE MOMENT HE BOUGHT MCA, Bronfman had been angling to expand its presence in music. His first move was to launch a new label with Doug Morris, who’d just been deposed as head of Warner’s U.S. music operation. Within months, Morris was running the entire Universal Music Group and Seagram had snapped up the half of Interscope Records that Time Warner, under pressure from the political right for its association with gangsta rap, had just dumped. But Bronfman had much bigger quarry in mind.

Hobbled by Matsushita’s penny-pinching management, MCA had sat out the merger mania of the early ’90s. It ranked fifth in U.S. music share; internationally, it was almost nonexistent. Within weeks of acquiring MCA, Bronfman had met with EMI’s chairman, Sir Colin Southgate. Later he had dinner with Cor Boonstra and Alain Levy, CEO of PolyGram, which had flourished as a Philips subsidiary under the patronage of Boonstra’s predecessor. Both music companies were huge global combines, far stronger internationally than in the U.S. But EMI was too pricey, and Levy, a barrel-chested man who’d gone into film in the attempt to make PolyGram a major entertainment conglomerate, was violently opposed to any deal. Bronfman bided his time.

By the end of 1997, with the Diller deal in the works and EMI’s stock somewhat deflated, Bronfman was back in talks with Southgate. Then Boonstra called: Could they meet? For Bronfman it must have been deja vu: Three years after buying MCA from Matsushita, he was again in talks with a troubled electronics company set on a turnaround path by a new CEO who was eager to undo his predecessor’s foray into entertainment—and just as eager to avoid the discomfiture of a public auction. Even so, the talks nearly came to grief over PolyGram’s film division, which Philips valued at $1 billion and Seagram at half that. But finally, in a series of late-night transatlantic phone calls, Bronfman said yes to a compromise price of $10.6 billion (later reduced to $10.4 billion).

That was in May 1998. It took seven months for the deal to close—seven months during which Seagram had to raise $8.6 billion in cash. Tropicana was promptly sold to PepsiCo for $3.3 billion. But though Seagram put a $1 billion price tag on PolyGram’s film assets, the highest bid it got was $500 million. In October, with no buyers in sight and its credit rating about to be downgraded, Seagram sold the bulk of PolyGram’s film library to MGM for $235 million and started hawking the remaining assets piecemeal. “You may have gotten a phone call yourself,” quips one PolyGram executive.

Meanwhile, the music industry was in limbo. By November it was clear that wholesale changes were in store—labels smashed together, thousands of employees laid off, hundreds of bands let go. The Geffen and A&M labels would be fused with Interscope under Jimmy Iovine, the bad-boy entrepreneur behind the Wallflowers and Tupac Shakur. Island would be folded in with Mercury. Total projected savings: $300 million per year.

For Bronfman, there was a precedent. In the ’80s, Seagram dropped dozens of low-end and mid-priced liquor brands in favor of the premium stuff, sacrificing volume and market share to concentrate on products with the best margins. Bronfman wants to do something similar with music. “If you can reduce your artist roster and focus your efforts in terms of promotion, marketing, and A&R,” he says, “you’ll do better economically, your artists will do better, and the better you do the more artists will want to come to your shop.”

What about the movie studio? That’s the question in Hollywood, where the rumor mill has been overheating on the future of Universal.

Rock bands aren’t liquor brands. The job of making sure they aren’t treated as such falls on Doug Morris, who was named to head the combined record companies last June. Heavyset and graying at 59, Morris is an old-style record exec who aims to bring the street smarts and personal feel of the independents into a corporate setting. “You can never replace David Geffen or Berry Gordy [of Motown],” he says. “But what you can do is try to put people in place who have those instincts.” Morris has put Jimmy Iovine in charge of three companies with more than $600 million in sales worldwide—and while marketing and promotion at Geffen and A&M have been nuked to save money, at least some of the people who sign bands are being retained. “We’re going to keep the identities of all three labels,” promises Iovine, lounging in an office whose funky couches and mammoth speakers give it the look of a teenager’s fantasy den.

Of all the businesses Seagram is in, music—its biggest bet—is undergoing the most profound secular change. With the rise of the Internet, the big music companies face two threats: unfettered piracy and, just possibly, their own obsolescence. MP3, an easily downloadable format, has so unnerved them that they’re suing Diamond Multimedia over its portable player, the Rio—a move that recalls the movie industry’s quixotic attempt two decades ago to stamp out videocassettes, now a major profit center. Of course, the big companies could save a bundle on manufacturing and distribution if they sold on the Net—but recording stars could do even better, some maintain, by selling on the Net themselves.

Others dismiss both fears as nonsense. “We’ve had piracy issues since there’s been tape,” says David Geffen. “What you see today is the record industry after piracy—and the net effect is, it’s up 8% to a record year. Can you sell a record that you’ve financed yourself? Sure—you’ve always been able to. The issue is the cost of making recordings—and then there’s getting them to the radio stations. Every home has a kitchen—does it mean that people don’t go to restaurants? Look, there are five record companies in the world. And being the biggest of the five is clearly a very good strategy.”

March 1, 1999

March 1, 1999